Quantifying New York’s 2009 June gloom using WeatherBill and Wolfram|Alpha

In the northeastern United States, scars are slowly healing from a miserably rainy June — torturous, according to the New York Times. Status updates bemoaned “where’s the sun?”, “worst storm ever!”, “worst June ever!”. Torrential downpours came and went with Florida-like speed, turning gloom into doom: “here comes global warming”.

But how extreme was the month, really? Was our widespread misery justified quantitatively, or were we caught in our own self-indulgent Chris Harrisonism, “the most dramatic rose ceremony EVER!”.

This graphic shows that, as of June 20th, New York City was on track for near-record rainfall in inches. But that graphic, while pretty, is pretty static, and most people I heard complained about the number of days, not the volume of rain.

I wondered if I could use online tools to determine whether the number of rainy days in June was truly historic. My first thought was to try Wolfram|Alpha, a great excuse to play with the new math engine.

Wolfram|Alpha queries for “rain New Jersey June 200Y” are detailed and fascinating, showing temps, rain, cloud cover, humidity, and more, complete with graphs (hint: click “More”). But they don’t seem to directly answer how many days it rained at least some amount. The answer is displayed graphically but not numerically (the percentage and days of rain listed appears to be hours of rain divided by 24). Also, I didn’t see how to query multiple years at a time. So, in order to test whether 2009 was a record year, I would have to submit a separate query for each year (or bypass the web interface and use Mathematica directly). Still, Wolfram|Alpha does confirm that it rained 3.8 times as many hours in 2009 as 2008, already one of the wetter months on record.

WeatherBill, an endlessly configurable weather insurance service, more directly provided what I was looking for on one page. I asked for a price quote for a contract paying me $100 for every day it rains at least 0.1 inches in Newark, NJ during June 2010. It instantly spat back a price: $694.17.

It also reported how much the contract would have paid — the number of rainy days times $100 — every year from 1979 to 2008, on average $620 for 6.2 days. It said I could “expect” (meaning one standard deviation, or 68% confidence interval) between 3.9 and 8.5 days of rain in a typical year. (The difference between the average and the price is further confirmation that WeatherBill charges a 10% premium.)

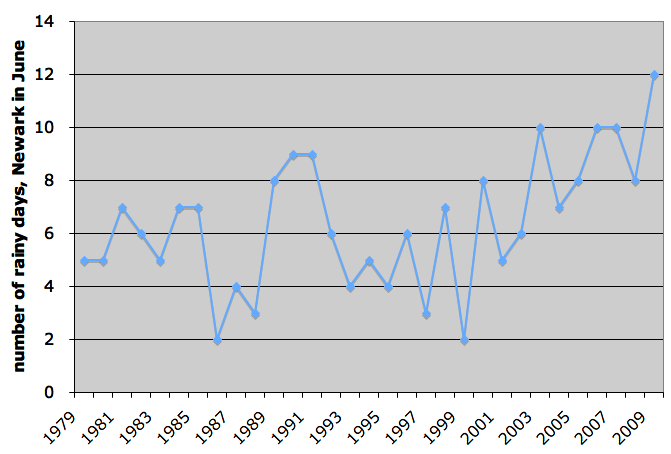

Below is a plot of June rainy days in Newark, NJ from 1979 to 2009. (WeatherBill doesn’t yet report June 2009 data so I entered 12 as a conservative estimate based on info from Weather Underground.)

Indeed, our gloominess was justified: it rained in Newark more days in June 2009 than any other June dating back to 1979.

Intriguingly, our doominess may have been justified too. You don’t have to be a chartist to see an upward trend in rainy days over the past decade.

WeatherBill seems to assume as a baseline that past years are independent unbiased estimates of future years — usually not a bad assumption when it comes to weather. Still, if you believe the trend of increasing rain is real, either due to global warming or something else, WeatherBill offers a temptingly good bet. At $694.17, the contract (paying $100 per rainy day) would have earned a profit in 7 of the last 7 years. The chance of that streak being a coincidence is less than 1%.

If anyone places this bet, let me know. I would love to, but as of now I’m roughly $10 million in net worth short of qualifying as a WeatherBill trader.

If we can get hold of how weatherbill calculated the price of $694.17 and how over the years the price changed with the previous years outcome.

I think there is a catch somewhere, because this looks like a win win thing….

Also does the price of the contract depends on your maximum coverage of $3000. It would be great to see how this changes if we tweak this 3000 figure to 2000….

I tried playing with figures in the contract and apparently, if we want to get only $1000(max) then the price of contract is less. However if we change this figure to $1500 or above then there is no difference in the price of the contract.

It shows that they themselves believe that it would not rain for more than 15 days at max in June 2010. I guess the new yorkers should be happy then 🙂

I guess precision in the rain data is greatest when money is directly involved such as in a predictions market.

I recall the Chamber of Commerce of Sequim, Washington as dividing all days into either rainy or sunny. However dark and menacing the clouds were all day, if it did not actually rain, that dark, dismal day was declared to be sunny.

Well, when there is money riding on a futures contract, search engines have to be more precise and lead to sites that are more precise.

Trading futures on rainfall in New Jersey? H’mmm… anyone know where I can hire a pilot who will seed clouds but keep his mouth shut?

Very interesting, Varun. That led me to explore different options. Here appears to be another good bet:

choose “only start paying me after 9 rainy days”

then the price is only $35.21 and you would have won $100 or more in 4 of the last 7 years. So almost 3-1 payoff at greater than 50/50 odds.

Interestingly, the odds do not adjust as you increase the stakes. So for $352,110.86 you can arrange to be paid $1 million every day it rains beyond the ninth day. It seems unlikely they would actually honor that price quote.

>hire a pilot who will seed clouds but keep his mouth shut?

Gee, I had expected a flurry of responses unrelated to the combinatorial and predictive issues.

Much of our weather reporting is from observation stations maintained by amateurs. Just as speculators often tried to ‘corner’ the market on wheat shipments by tying up all barge traffic to Chicago, don’t you think speculators on rainfall contracts will think of such things as fudging the rainfall data?

Its cheap, easy and profitable. Someone will eventually stoop to it.

A prediction market has to be vigilant to such things if it is to survive.

>hire a pilot who will seed clouds but keep his mouth shut?

FoolsGold: I like the way you’re thinking. 🙂 Weather is one of the purest prediction settings, yet even there technology is creeping in to allow manipulation. Hmm, maybe predicting sunspot activity is “safe” for at least the next decade.

Its not just the technology to alter the actual situation but the cheap and easy to use technology to alter the data relating to that situation.

Most weather reporting stations are unattended automated devices whose geographic coordinates and hours of being attended are available on the web. Anything from tapping into the data cable to using a garden hose would alter the rain data.

Just as some live sporting events have faced result-altering glitches that affect the odds makers but not the teams, some futures contracts may face result altering data manipulation that could well involve little more than a nocturnal sprinkling of a glass of water onto an unattended fence post.

Normally one would not expect such a thing to take place, but once the element of substantial amounts of money enters into the picture, things like demolishing a power station near a stadium to disrupt the event is going to be very profitable.

> using a garden hose

>

> sprinkling of a glass of water onto an unattended fence post

Wow, smart: now I really like the way you are thinking. You’re right.

If it is real info then it’s a big surprise. Anyways thanks for sharing with us.

Update: Had you followed my goodbet you would have lost. June 2010 in New Jersey was a near drought. I still think it’s a good bet. The price for June 2011 is actually a bit lower: $657.55.

For some strange reason, WeatherBill is still not reporting what the contract payout would have been in 2009.

Update 2: I asked and WeatherBill is not updating that data, but rather focusing on some of their new contract types like this one: http://www.weatherbill.com/products/q/rainydays