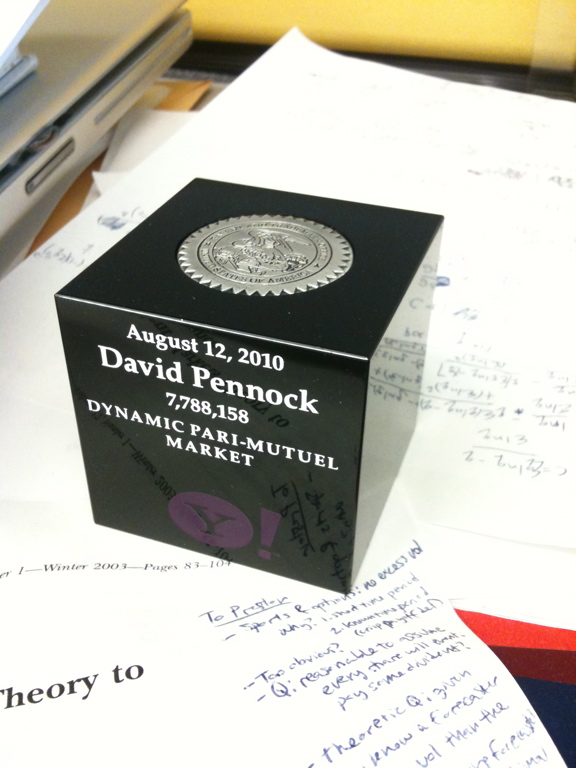

One of the few aspects of my job I enjoy more than designing a new market is actually building it. Turning some wild concept that sprung from the minds of a bunch of scientists into a working artifact is a huge rush, and I can only smile as people from around the world commence tinkering with the thing, often in ways I never expected. The “build it†phase of a research project, besides being a ton of fun, inevitably sheds important light back on the original design in a virtuous cycle.

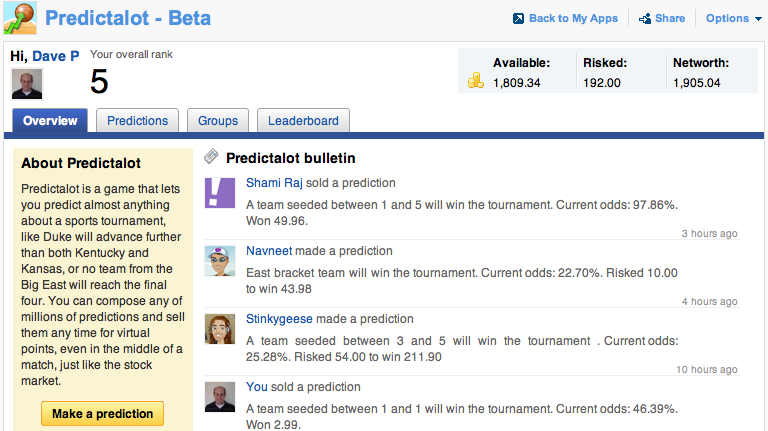

In that vein, I am thrilled to announce the beta launch of PredictWiseQ, a fully operational example of our latest combinatorial prediction market design: “A tractable combinatorial market maker using constraint generation”, published in the 2012 ACM Conference on Electronic Commerce.

You read the paper.1 Â Now play the game.2 Help us close the loop.

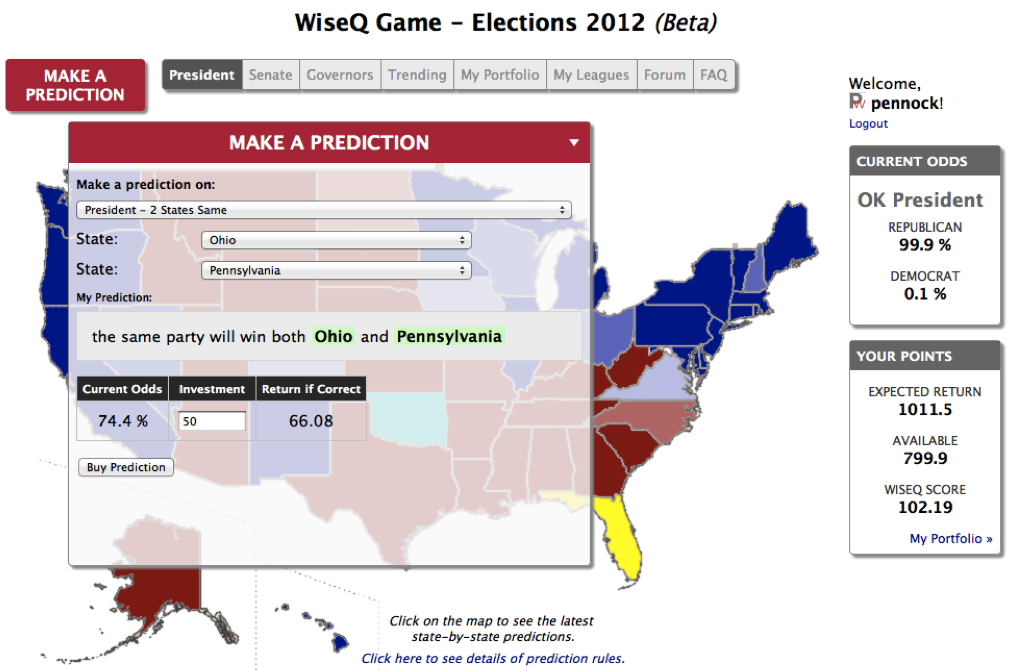

PredictWiseQ is our greedy attempt to scarf up as much information as is humanly possible and use it, wisely, to forecast nearly every possible detail about the upcoming US presidential election. For example, we can project how likely it is that Romney will win Colorado but lose the election (6.2%), or that the same party will win both Ohio and Pennsylvania (77.6%), or that Obama will paint a path of blue from Canada to Mexico (99.5%). But don’t just window shop, go ahead and customize and buy a prediction or ten for yourself. Your actions help inform the odds of your own predictions and, crucially, thousands of other related predictions at the same time.

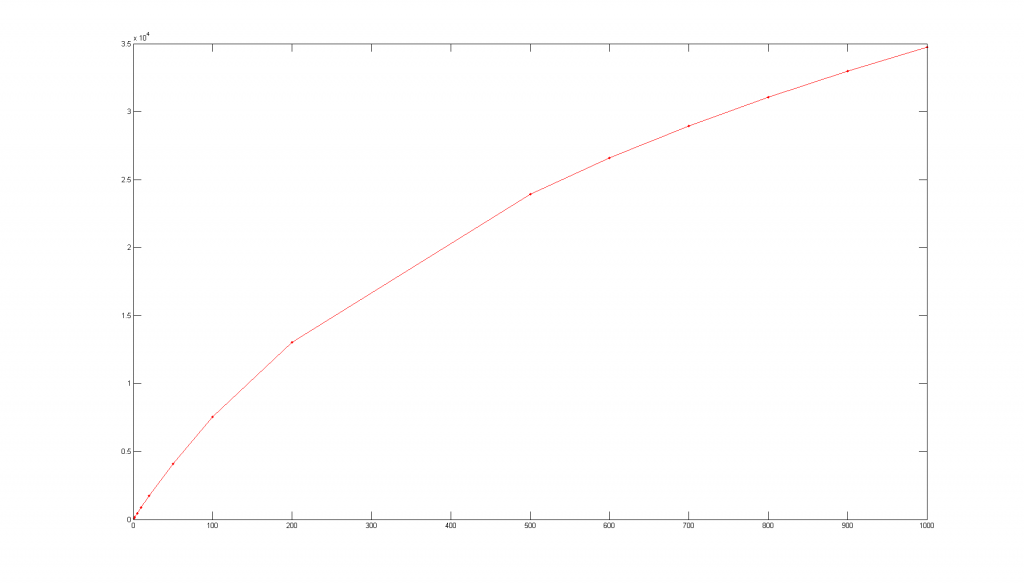

For example, a bet on Obama to win both Ohio and Florida can automatically raise his odds of winning Ohio alone. That’s because our market maker knows and enforces the fact that Obama winning OH and FL can never be more likely than him winning OH. After every trade, we find and fix thousands of these logical inconsistencies. In other words, our market maker identifies and cleans up arbitrage wherever it finds it. But there’s a limit to how fastidious our market maker can be. It’s effectively impossible to rid the system of all arbitrage: doing so is NP-hard, or computationally intractable. So we clean up a good bit of arbitrage, but there should be plenty left.

So here’s a reader’s challenge: try to identify arbitrage on PredictWiseQ that we did not. Go ahead and profit from it and, when you’re ready, please let me and others know about it in the comments. I’ll award kudos to the reader who finds the simplest arbitrage.

Why not leave all of the arbitrage for our traders to profit from themselves? That’s what nearly every other market does, from Ireland-based Intrade, to Las Vegas bookmakers, to the Chicago Board Options Exchange. The reason is, we’re operating a prediction market. Our goal is to elicit information. Even a completely uninformed trader can profit from arbitrage via a mechanical plug-and-chug process. We should reserve the spoils for people who provide good information, not those armed (solely) with fast or clever algorithms. Moreover, we want every little crumb of information that we get, in whatever form we get it, to immediately impact as many of the thousands or millions of predictions that it relates to as possible. We don’t want to wait around for traders to perform this propagation on their own and, besides, it’s a waste of their brain cells: it’s a job much better suited for a computer anyway.

Intrade offers an impressive array of predictions about the election, including who will win in all fifty states. In a sense, PredictWiseQ is Intrade to the 57th power. In a combinatorial market, a prediction can be any (Boolean) function of the state outcomes, an ungodly degree of flexibility. Let’s do some counting. In the election, there are actually 57 “states”: 48 winner-takes-all states, Washington DC, and two proportional states — Nebraska and Maine — that can split their electoral votes in 5 and 3 unique ways, respectively. Ignoring independent candidates, all 57 base “states” can end up colored Democratic blue or Republican Red. So that’s 2 to the power 57, or 144 quadrillion possible maps that newscasters might show us after the votes are tallied on November 6th. A prediction, like “Romney wins Ohioâ€, is the set of all outcomes where the prediction is true, in this case all 72 quadrillion maps where Ohio is red. The number of possible predictions is the number of sets of outcomes, or 2 to the power 144 quadrillion. That’s more than a googol, though less than a googolplex (maybe next year). To get a sense of how big that is, if today’s fastest supercomputer starting counting at the instant of the big bang, it still wouldn’t be anywhere close reaching a googol yet.

Create your own league to compare your political WiseQ among friends. If you tell us how much each player is in for, we’ll tell you how to divvy things up at the end. Or join the “Friends Of Dave” (FOD) league. If you finish ahead of me in my league, I’ll buy you a beer (or beverage of your choice) the next time I see you, or I’ll paypal you $5 if we don’t cross paths.

PredictWiseQ is part of PredictWise, a fascinating startup of its own. Founded by my colleague David Rothschild, PredictWise is the place to go for thousands of accurate, real-time predictions on politics, sports, finance, and entertainment, aggregated and curated from around the web. The PredictWiseQ Game is a joint effort among David, Miro, Sebastien, Clinton, and myself.

The academic paper that PredictWiseQ is based on is one of my favorites — owed in large part to my coauthors Miro and Sebastien, two incredible sciengineers. As is often the case, the theory looks bulletproof on paper. But I’ve learned the hard way many times that you don’t really know if a design is good until you try it. Or more accurately, until you build it and let a crowd of other people try it.

So, dear crowd, please try it! Bang on it. Break it. (Though please tell me how you did, so we might fix it.) Tell me what you like and what is horribly wrong. Mostly, have fun playing a market that I believe represents the future of markets in the post-CDA era, a.k.a the digital age.

__________

1 Or not.

2 Or not.