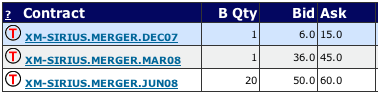

I am happy to report that on my suggestion intrade has listed futures contracts for 2008 search engine market share.

Here is how they work:

A contract will expire according to the percentage share of internet searches conducted in the United States in 2008. For example, if 53.5% of searches conducted in the United States in 2008 are made using Google then the contract listed for Google will expire at 53.5…

…Expiry will be based on the United States search share rankings published by Nielson Online.

I think this could be a fascinating market because:

- Search engine market share is very important to these major companies, with dramatic effects on their share prices.

- Search engine market share is fluid, so far with Google growing inexorably. However, Microsoft has cash, determination, Internet Explorer, and the willingness to experiment. Ask.com has erasers, 3D, ad budgets, and The Algorithm. Yahoo!, second in market share, often tests equal or better than Google, and new features like Search Assist are impressive.

- The media loves to write about it.

- A major search company might use the market to hedge. Well, this seems far-fetched but you never know. Certainly, from an economic risk management standpoint it would seem to make a great deal of sense. (Here, as always on this blog, I speak on behalf of myself and not my company.)

Finally, I have to comment on how refreshingly easy the process was in working with intrade. They went from suggestion to implementation in a matter of days. It’s a shame that US-based companies are in contrast stuck in stultifying legal and regulatory mud.

Addendum 2008/01/26: Here are links to some market research reports:

Nielsen | ComScore | HitWise | Compete

(It seems that Nielsen Netratings homepage is down; getting 404 error at the moment)

Addendum 2008/03/07: If you prefer, you can now also bet on search share just for fun with virtual currency at play.intrade.com.

(Nielsen Netratings homepage is still down, now for over a month. It’s even more ridiculous given that their own Nielsen Online website points to this page.)