- The Second Conference on Auctions, health more about Market Mechanisms and Their Applications (AMMA) is next Monday and Tuesday August 22-23, generic view 2011, web at CUNY in midtown manhattan. The program, including contributed talks on school choice, prediction markets, advertising, and market design, and invited talks by market designer extraordinaire Peter Cramton and private company stock exchange SecondMarket (where millionaires buy Facebook), look to be excellent. Hope to see you there!

- The fourth annual New York Computer Science and Economics Day (NYCE Day) is Friday, September 16, 2011, at NYU. You have until next Friday August 26 to submit a short talk or poster. The goal of the meeting is to bring together researchers in the larger New York metropolitan area (read: DC-Boston-Chicago) with interests in computer science, economics, marketing, and business, and a common focus in understanding and developing the economics of Internet activity.

Category Archives: economics

On Intrade CEO John Delaney’s death

A few words on the tragic death last May of John Delaney, the founder and CEO of prediction market company Intrade. John died near the peak of Mount Everest, climbing toward one of his life’s dreams and leaving behind a wife and three children, including one born only days before he died that he never met.

John founded Tradesports, a pre-cursor to Intrade, in 2000. Eventually, the non-sports contracts on Tradesports where spun off as Intrade, and Tradesports was shut down in 2008, in hopes of obtaining U.S. regulatory approval. I remember marveling at the technology, featuring ajax-ian magic like push updates — new bids appeared and filled bids disappeared live in a flash of color — well before its time, before we even knew what to call it.

The prediction market community embraced John, and John them. John was happy to take academics’ quixotic market ideas — like combinatorial markets, decision markets, merger markets, tax markets, or search engine markets — and float them on Tradesports or Intrade, and share back data for academic studies. I remember when we learned a Director at Intrade would speak at the first Prediction Markets Summit in 2005, we were thrilled to hear from a pioneer and innovator: one of the “big guns”. Chris Hibbert asked, “isn’t Tradesports the largest prediction market in the world?” It was hard to say: in a way, yes, it was and still is the largest market widely identified with the adjective ‘prediction’, but of course it depends how you define it: does Betfair count? Vegas? Stock options? If I recall, John himself spoke remotely at the second PM summit in New York.

Intrade became the prototypical example of a prediction market, mentioned in almost every academic paper on the subject. In 2008, Betfair, a goliath to Intrade’s David in terms of revenue and profit, got so annoyed they lashed out and sent the following attack on Intrade and defense of their own service dubbed Betfair Predicts (now shuttered):

InTrade’s election charts are republished frequently—despite continuing

problems with market manipulation.Betfair is the world’s largest commercial prediction market with $33

Billion per year flowing through its exchange and is well known for

integrity and advanced technology…

I don’t believe I met John in person, but he and I emailed a bit, and beyond being whip smart and a fantastic entrepreneur, John was simply an incredibly nice guy. He kept repeating, at the end of nearly every email, that I must come to London so we could meet and have a beer. Talking to others, it seems I am far from alone in this standing offer from John. On the original prediction market mailing list, John Delaney was always the peacemaker: always diplomatic and rising about some surprisingly testy exchanges. He always spoke to raise the prominence of the field as a whole, ahead of his own interests with Intrade, not only believing but acting on his belief that “a rising tide lifts all boats”.

John didn’t seem like the type to seek out risk for the simple thrill of it; rather, he took calculated risks in business and life to progress. His success at work and at home attest to this. In hindsight, it’s easy to say he calculated wrong in attempting to climb Everest, but especially among prediction market proponents we know that decisions cannot be evaluated in hindsight. Decisions must be judged based on the information available at the time the decision is made. My guess is that John knew the risks and felt the climb was a gamble worth taking in an effort to achieve a long-standing goal and to accomplish a feat few others on the planet can claim.

John, you will be sorely missed, but your legacy lives on at Intrade, in the prediction market community, among your family and friends, and in the business world, sadly and suddenly now missing one of it’s great entrepreneurs with a spirit of adventure.

2011 ACM Conference on Electronic Commerce and fifteen other CS conferences in San Jose

If you’re in the Bay Area, come join us at the 2011 ACM Conference on Electronic Commerce, June 5-9 in San Jose, CA, one of sixteen conferences that comprise the ACM Federated Computing Research Conference, the closest thing we have to a unified computer research conference.

The main EC’11 conference includes talks on prediction markets, crowdsourcing, auctions, game theory, finance, lending, and advertising. The papers span a spectrum from theoretical to applied. If you want evidence of the latter, look no further than the roster of corporate sponsors: eBay, Facebook, Google, Microsoft, and Yahoo!.

There are also a number of interesting workshops and tutorials in conjunction with EC’11 this year, including:

- 7th Ad Auction Workshop

- Workshop on Bayesian Mechanism Design

- Workshop on Social Computing and User Generated Content

- 6th Workshop on Economics of Networks, Systems, and Computation

- Workshop on Implementation Theory

- Bayesian Mechanism Design

- Conducting Behavioral Research Using Amazon’s Mechanical Turk

- Matching and Market Design

- Outside Options in Mechanism Design

- Measuring Online Advertising Effectiveness

The umbrella FCRC conference includes talks by 2011 Turing Award winner Leslie G. Valiant, IBM Watson creator David A. Ferrucci, and CMU professor, CAPTCHA co-inventor, and Games With a Purpose founder Luis von Ahn.

Hope to see many of you there!

Crowdpark: Taking Facebook and now Florida by storm

Crowdpark is an impressive, well-designed prediction market game that’s already attracted 500,000 monthly active users on Facebook, the 11th fastest growing Facebook app in April.

Crowdpark is an impressive, well-designed prediction market game that’s already attracted 500,000 monthly active users on Facebook, the 11th fastest growing Facebook app in April.

It’s a dynamic betting game with an automated market maker, not unlike Inkling Markets in functionality (or even Predictalot minus the combinatorial aspect). What stands out is the flashy UI, both literally and figuratively. The look is polished, slick, refreshing, and richly drawn. It’s also cutesy, animation-happy, and slow to load. Like I said, Flash-y in every way. The game is well integrated into Facebook and nicely incorporates trophies and other social rewards. Clearly a lot of thought and care went into the design: on balance I think it came out great.

Crowdpark is a German company with an office in San Francisco. In addition to their Facebook game, they have German and English web versions of their game, and white-label arrangements with gaming companies. They launched in English just last December.

Crowdpark’s stunning growth contrasts with decidedly more mixed results on this side of the Atlantic. I wonder how much of Crowdpark’s success can be attributed to their German roots, their product, their marketing, or other factors?

Crowdpark has an automated market maker they call “dynamic betting” that I can’t find any technical details about [1]. Here’s their well-produced video explanation:

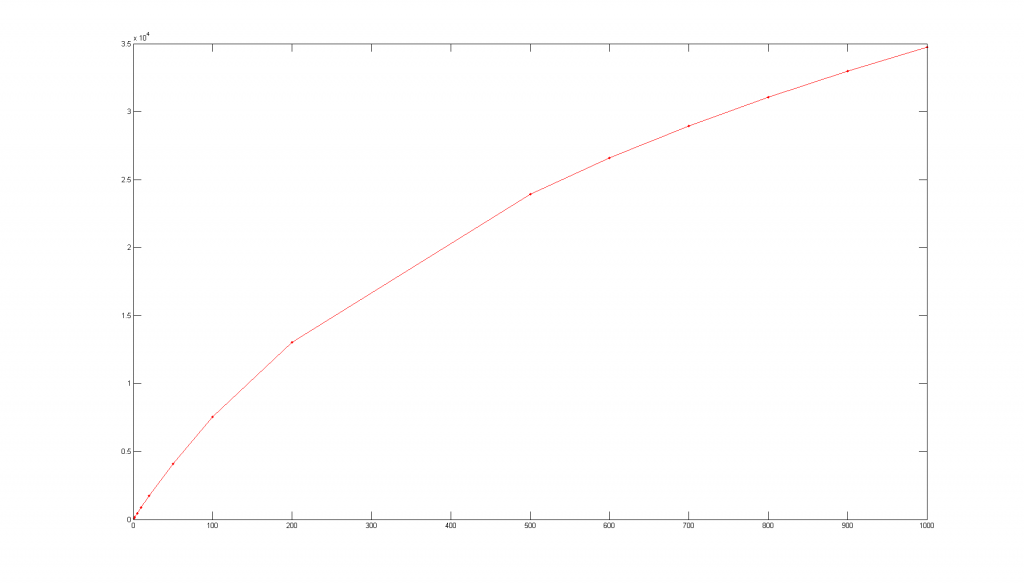

They say it’s “patent pending”, though my colleague Mohammad Mahdian did some nice reverse engineering to show that, at least in their Facebook game, they’re almost certainly using good-old LMSR. Here is a graph of Crowdpark’s market maker price curve for a bet priced at 1%:

Here is the raw data and the fit to LMSR with b=20,000.

| risk | to win (CP) | to win (LMSR) |

| 1 | 91 | 91.079482 |

| 2 | 181 | 181.750593 |

| 5 | 451 | 451.350116 |

| 10 | 892 | 892.847929 |

| 20 | 1747 | 1747.952974 |

| 50 | 4115 | 4115.841760 |

| 100 | 7535 | 7535.378665 |

| 200 | 13019 | 13019.699483 |

| 500 | 23944 | 23944.330406 |

| 600 | 26594 | 26594.687310 |

| 700 | 28945 | 28945.633048 |

| 800 | 31059 | 31059.076097 |

| 900 | 32979 | 32979.512576 |

| 1000 | 34740 | 34740.000000 |

Still, there’s a quote buried in the video at 0:55 that caught my attention: “you’re current profit is determined by the fluctuation of the odds”.

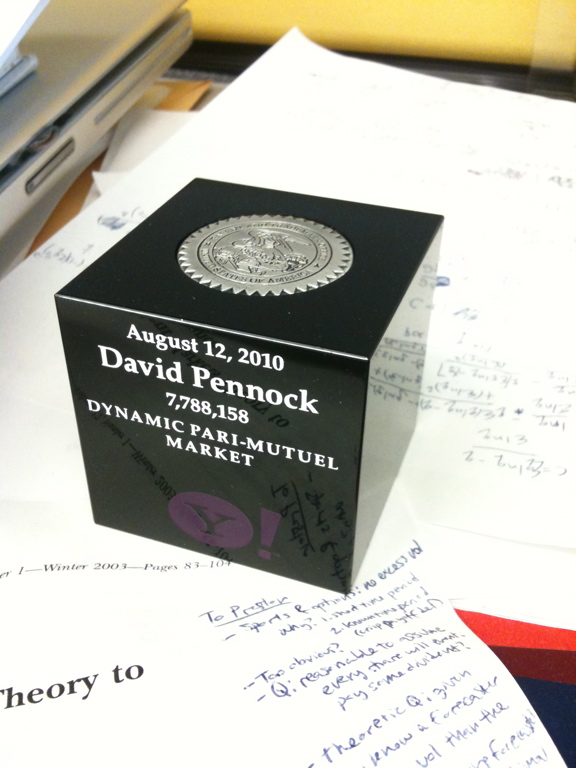

There’s only one market maker that I know of where the profit fluctuates with the odds, and that’s my own dynamic parimutuel market, which by coincidence recently went from patent pending to inventor cube delivered. 🙂

With every other market maker, indeed almost every prediction market, the profit is fixed at the time of the bet. Add to that the fact that Crowdpark bought a majority stake in Florida horse racing circuit Saratoga Racing Inc. and plans to operate all bets exclusively through their system, leads me to wonder if they may have some kind of parimutuel variant, the only style of betting that is legal in the US.

Of course, it may be that I simply misinterpreted the video.

[1] The technical exec at Crowdpark seems to be Aleksandar Ivanov. I found a trade press paper on (internal) prediction markets he wrote in 2009 for the Journal of Business Forecasting.

Four free registrations to EC’11 for students

Thanks to a generous donation from Google, we are offering four free registrations for students to attend the 2011 ACM Conference on Electronic Commerce (EC’11) in San Jose.

To apply, please email David Pennock and Yoav Shoham by Wednesday May 11, 2011, with subject “YourLastName: EC’11 student registration award application” and include:

- Your name, university, personal homepage, and current student status (e.g., 2nd year Ph.D. student)

- Whether you are a member of ACM SIGecom

- Any papers at EC’11 for which you are an author or co-author

- Any papers at an EC’11 affiliated workshop (or under review) for which you are an author or co-author

- Please also arrange for your academic advisor to email verification of your student status in good standing to the same two email addresses with your last name in the subject.

Applications must be submitted by Wednesday May 11, 2011. We will award the four free registrations by Friday May 13, prior to the early registration deadline of May 16.

thanks,

David Pennock, Chair ACM SIGecom

Yoav Shoham, General Chair, EC’11

P.S. This was announced on April 14 on the mailing list for the ACM Special Interest Group on Electronic Commerce (SIGecom). If you missed it, you should join! 🙂

There’s a new oracle in town

Last January, a few friends and I visited the sportsbook at the M Casino in Las Vegas, one of several sportsbooks now run by Cantor Gaming, a division of Wall Street powerhouse Cantor Fitzgerald. Traditional sportsbooks stop taking bets when the sporting event in question begins. In contrast, Cantor allows “in-running betting”, a clunky phrase that means you can bet during the event: as touchdowns are scored, interceptions are made, home runs are stolen, or buzzers are beaten. Cantor went a step further and built a mobile device you can carry around with you anywhere in the casino to place your bets while watching games on TV, drink in hand. (Cantor also runs spread-betting operations in the UK and bought the venerable Hollywood Stock Exchange prediction market with the goal of turning it into a real financial exchange; they nearly succeeded, obtaining the green light from the CFTC before being shut down by lobbyists, er, Congress.)

Last January, a few friends and I visited the sportsbook at the M Casino in Las Vegas, one of several sportsbooks now run by Cantor Gaming, a division of Wall Street powerhouse Cantor Fitzgerald. Traditional sportsbooks stop taking bets when the sporting event in question begins. In contrast, Cantor allows “in-running betting”, a clunky phrase that means you can bet during the event: as touchdowns are scored, interceptions are made, home runs are stolen, or buzzers are beaten. Cantor went a step further and built a mobile device you can carry around with you anywhere in the casino to place your bets while watching games on TV, drink in hand. (Cantor also runs spread-betting operations in the UK and bought the venerable Hollywood Stock Exchange prediction market with the goal of turning it into a real financial exchange; they nearly succeeded, obtaining the green light from the CFTC before being shut down by lobbyists, er, Congress.)

Back to the device. It’s pretty awesome. It’s a Windows tablet computer with Cantor’s custom software — pretty well designed considering this is a financial firm. You can bet on the winner, against the spread, or on one-off propositions like whether the offensive team in an NFL game will get a first down, or whether the current drive will end with a punt, touchdown, field goal, or turnover. The interface is pretty nice. You select the type of bet you want, see the current odds, and choose how much you want to bet from a menu of common options: $5, $10, $50, etc. You can’t bet during certain moments in the game, like right before and during a play in football. When I was there only one game was available for in-running betting. Still, it’s instantly gratifying and — I hate to use this word — addictive. Once my friend saw the device in action, he instantly said “I’m getting one of those”.

When I first heard of Cantor’s foray into sports betting, I assumed they would build “betfair indoors”, meaning an exchange that simply matches bettors with each other and takes no risk of its own. I was wrong. Cantor’s mechanism is pretty clearly an intelligent automated market maker that mixes prior knowledge and market forces, much like my own beloved Predictalot minus the combinatorial aspect. Together with their claim to welcome sharps, employing a market maker means that Cantor is taking a serious risk that no one will outperform their prior “too much”, but the end result is a highly usable and impressively fun application. Kudos to Cantor.

P.S. Cantor affectionately dubbed their oracle-like algorithm for computing their prior as “Midas”, proving this guy has a knack for thingnaming.

CFP: Auctions, Market Mechanisms, and their Applications

From Peter Coles:

There is [less than] one week left to submit papers to AMMA, [The Second Conference on Auctions, Market Mechanisms and Their Applications], a market design conference that will be held in NYC this August. The conference brings together economists, computer scientists and practitioners who are interested in the use of market mechanisms to solve problems.

The best way to decide whether to submit to a conference you haven’t heard of is to look at the organizers and program committee. In this case, they’re superb.

It’s Arab Spring, but is it Prediction Market Winter?

Is the growing prediction market industry graveyard an omen?

It’s hard to ignore the accumulating bodies, including, may they rest in peace, PPX, Hubdub, Protrade, Tradesports, Newsfutures, Hedgestreet, Yoonew, TheTicketReserve, FirstDibz, BettorFan, ipreo, Tech Buzz Game, The WSX, Storage Markets, FTPredict, real HSX, BizPredict [1], CasualObserver.net, Cenimar, Alexadex [2], Askmarkets, Truth Markets, BetBubble, Betocracy, CrowdIQ, Media Mammon, Owise, RIMDEX, Trendio [3], TwoCrowds, BBC celebdaq/sportdaq, Betfair Predicts, chrisfmasse.com [4], and more.

Is this churn rate normal for startups in general, even healthy? Is it a sign of PM’s place in the trough of the hype cycle? Is the current climate an opportunity for those left standing or someone new? Or does it simply suggest that prediction market proponents like me have lost?

A number of media-PM partnerships which on their face seem perfectly natural are history: USA Today+Newsfutures, Popular Science+HSX, Business 2.0+ConsensusPoint, Financial Times+Intrade, Techcrunch+Askmarkets [5], ABC7+Inkling [6], and CFO Magazine+Crowdcast.

At least two former PM companies found success only after switching gears: Protrade became Citizen Sports before being acquired by Yahoo! and Nigel euthanized Hubdub to focus on FanDuel. Cocision, launched just last fall, has already abandoned its PM roots in favor of breezy Q&A and voting.

Usable Marketeer Alex Kirtland nails exactly why all the “predict Wall Street” games may be fun but aren’t likely to be predictive. Research papers, including my own, report that the accuracy advantage of prediction markets, while real, may often be small compared to statistical models or polls.

Intrade, one of the most cited and well studied PMs, is trying hard with a radical remake that looks great and a new fee structure that’s likely to improve low-probability predictions. I don’t have any inside knowledge but the company and the exchange don’t seem especially strong; I even spotted some bugs in their exchange rules. The venerable Iowa Electronic Market and Foresight Exchange that, together with Robin, started it all, look, well, venerable. Betfair is still a powerhouse and soared in its IPO just last fall, but is perhaps showing signs of age as personnel turn over and the product remains decidedly 1.0.

A few startups like Crowdcast, MediaPredict, smarkets, betable, socialico/PremierX, and InklingMarkets are nimble and promising, but none have hit home runs yet. The SimExchange is well designed and chugging along. Bet2Give [7] and CentSports are both fascinating concepts and still alive, two of the most intriguing real-money markets. Others like ExtZy, RealityMarkets and PublicGyan are hanging on. New entrants like Prediculous, Predictalot, Predictopus, 4cast, beansight, I Called It, IBET, Prediction Book, HuffPo’s Predict the News, Slate’s Lean/Lock, Ultrinsic, Knew The News, Cantor Gaming’s Oracle [8], and the MNI Forecast Competition (Lumenogic) are still coming up, though at an admittedly slower pace than four years ago.

Update 2011/5/10: Crowdpark, a German company with an office in San Francisco, launched in English last December with a web game and an impressive, well-designed Facebook game that’s already attracted 500,000 monthly active users, the 11th fastest growing Facebook app in April. They have an interesting “patent pending” automated market maker that I can’t find any details about (yet).

One PM mailing list is of questionable transparency and another is often silent. The Prediction Market Industry Association is inactive.

The final post on Newfutures Blog in 2009 declares that “resistance is futile”. But is it the world’s resistance of PMs, or PMs resistance of irrelevance, that is futile?

Despite the negative tone of this post, I believe it’s the former. The prediction market spring will come. Here’s why. Prediction markets offer:

- Accountability

- Meritocracy

- A marketplace to reward information release

- Real-time updates

- Accuracy

- Increasing ease of use, as the technology matures and diffuses

- Self funding

No other prediction technology offers the same. There’s a great opportunity here for the companies that have squirreled away enough nuts to survive the winter.

P.S. Also read Paul Hewitt’s Prediction Market Prospects 2010.

Footnotes:

[1] In 2006, the teaser prediction for BizPredict was “Do you know when MySpace’s traffic will surpass Yahoo’s?”.

[2] Techcrunch declared Alexadex “the web 2.0 stock market”, back when Techcrunch encouraged Diggs

[3] I like Trendio’s post-mortem:

..Trendio rapidly became popular and attracted massive traffic from all over the world, as well as attention from major newspapers, TV-channels and blogs. To develop Trendio as a large-scale web property and an income-generating business would however have required to dedicate time and resources that I wasn’t able to provide.

I still believe there is a massive potential for prediction markets, both as games and for their predictive power…

[4] A truly sad loss, and not just because of the 2005 awards. Someone should archive the archive to be sure this gem, as information-rich as it was verbose and disorganized, survives. Hang in there Midas Oracle!

[5] Ironically, upon launch of Askmarkets in 2008 Techcrunch asked “who’s going to the deadpool?”

[6] Technically not dead, but seems neglected.

[7] We independently considered an idea similar to bet2give at Yahoo! in 2007 but never pursued it.

[8] Cantor Gaming’s odd-setting mechanism seems effectively like an automated market maker with intelligent prior.

Predictopus in the Times of India

Today, Yahoo! placed two full-page ads on the back cover of the Times of India, the largest English-language daily in the world, to promote Yahoo! Cricket, a site that reaches 13.4 percent of everyone online in India and serves as the official website of the ICC Cricket World Cup.

Take a look at the middle right of the second page: it says “Play exciting games and win big” and features… Predictopus! That’s the Indian spinoff of Predictalot, the combinatorial prediction game I helped invent.

Predictopus has nearly 70,000 users and counting, and this ad certainly won’t hurt.

Yahoo!!!

BTW, I grabbed these images from an amazing site called Press Display, which I discovered via the New York Public Library.

Times of India Mumbai edition

30 Mar 2011

Times of India Mumbai edition

30 Mar 2011

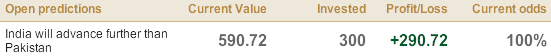

Also, congrats India, and thanks! I nearly doubled my virtual bet with the victory:

Workshops @ACM Electronic Commerce: Ad Auctions, Social Computing, June 5, 2011

The 2011 ACM Conference on Electronic Commerce will be held June 5-9 in San Jose as part of the ACM Federated Computing Research Conference. FCRC is a collection of seventeen computer science conferences with joint plenary speakers, this year featuring David A. Ferrucci, head of IBM’s Watson project, CMU professor and GWAP founder Luis von Ahn, and 2011 Turing Award winner Leslie Valiant. I’d love to someday see a true unified computer science conference in the style of the math or economics national meetings. Barring that, FCRC is the next-best thing. I hope more conferences will join.

The EC’11 list of accepted papers is out and the program looks great (including six papers from Yahoo! authors). And it’s not too late to submit a paper to one of the associated workshops. Two of particular interest, both on June 5, 2011, are:

Workshop on Social Computing and User Generated Content

The workshop will bring together researchers and practitioners from a variety of relevant fields, including economics, computer science, and social psychology, in both academia and industry, to discuss the state of the art today, and the challenges and prospects for tomorrow in the field of social computing and user generated content.

Social computing systems are now ubiquitous on the web– Wikipedia is perhaps the most well-known peer production system, and there are many platforms for crowdsourcing tasks to online users, including Games with a Purpose, Amazon’s Mechanical Turk, the TopCoder competitions for software development, and many online Q&A forums such as Yahoo! Answers. Meanwhile, the user-created product reviews on Amazon generate value to other users looking to buy or choose amongst products, while Yelp’s value comes from user reviews about listed services…

SUBMISSIONS DUE April 15, 2011, 5pm EDT

Seventh Ad Auctions Workshop

In the past decade we’ve seen a rapid trend toward automation in advertising, not only in how ads are delivered and measured, but also in how ads are sold… The rapid emergence of new modes for selling and delivering ads is fertile ground for research from both economic and computational perspectives…

We solicit contributions of two types: (1) research contributions, and (2) position statements…

Submission deadline: April 15th, 2011 (midnight Hawaii Time)