Gambling has been mocked as “a tax on the mathematically challenged”. Gamblers are stereotyped as losers in life. Casinos reinforce this by literally kicking out people who display too much intelligence. They ban card counting and people who simply win too much. They don’t allow computers or Internet connections in the sports book to block out information. They emphasize familiarity over innovation, cementing their appeal to habitual gamblers over geeks.

In the eyes of a casino, a sharp is indistinguishable from a cheat. More than boring, this seems fundamentally unfair and unsustainable, inviting disguise. It also turns off a wealthy, influential, and game-loving segment of the population.

In the eyes of a casino, a sharp is indistinguishable from a cheat. More than boring, this seems fundamentally unfair and unsustainable, inviting disguise. It also turns off a wealthy, influential, and game-loving segment of the population.

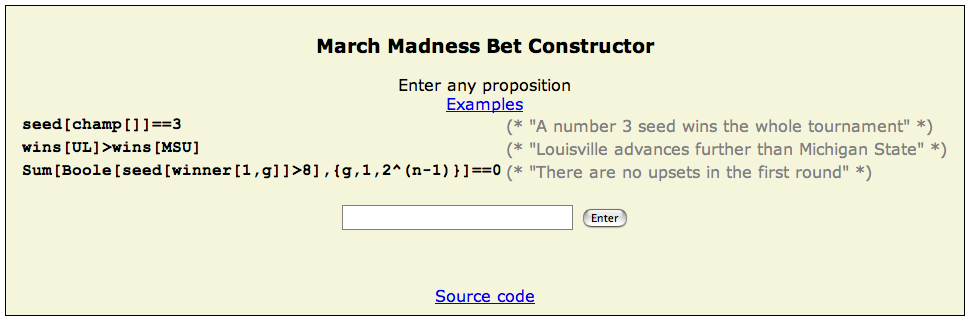

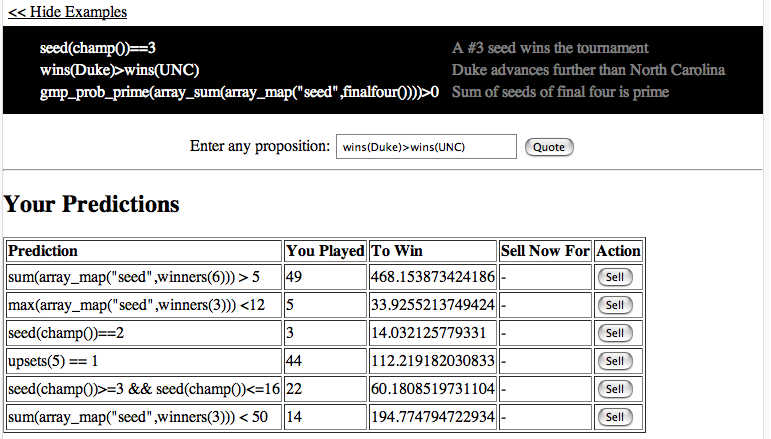

What I want: A casino by geeks for geeks that celebrates innovation, encourages cleverness, welcomes gadgets and wifi, and fosters hacking, outwit, and outplay.

At least one casino has seen the light. The M Casino in Las Vegas is parterning with Cantor Fitzgerald to support in-game sports betting with few rules and caps, inviting sharps to, more or less, “bring it on”.

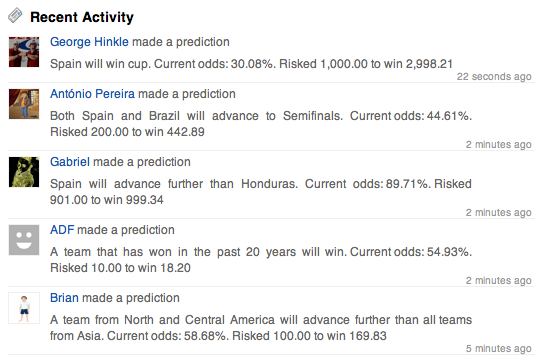

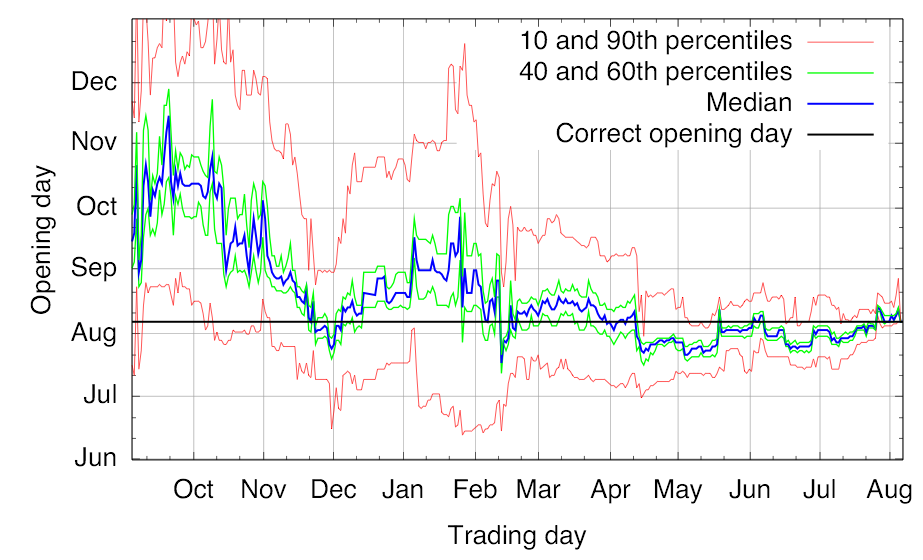

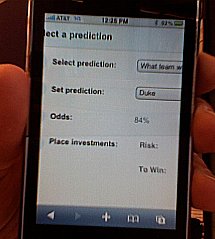

…gamblers can bet on the game even during play, accepting ever-changing point-spreads and odds. They can invest money on a Knicks foul shot going through the hoop or a Dodger getting to first base — contending with ever-evolving odds.

More critically, bettors can create hedges while jumping in and out of positions. But instead of buying into the fast-breaking moves of Microsoft, they’re betting on the Mariners’ impending fortunes.

This form of wagering is new to Las Vegas but old-hat in other markets.

…unlike in most other casinos, laptop computers are welcome.

…”The M wants [sharp bettors] to be there,” believes [professional sports-bettor Steve] Fezzik. “They want your information, and that’s a progressive attitude.”

Kudos to M for taking a chance on a more interesting future and to Cantor for making it happen.

What Cantor is debuting may not be a whole lot more than betfair indoors, but it’s a long overdue start. Here’s to hoping we see even more innovation, including smarter and more expressive markets.