Twenty-six researchers from Microsoft Research labs in Boston, China, India, Israel, New York City, Redmond, Silicon Valley, and the United Kingdom co-authored a remarkable seventeen of the eighty papers published in the 2014 ACM Conference on Economics and Computation (EC’14).

Moshe Babaioff served as General Chair for the conference and many other Microsoft Researchers served roles including (senior) PC members, workshop organizers, and tutorial speakers.

For research at the intersection of economics and computation, IMHO there’s no stronger “department” in the world than MSR.

Sébastien Lahaie and Jennifer Wortman Vaughan co-authored three papers each. Remarkably, Jenn accomplished that feat and gave birth!

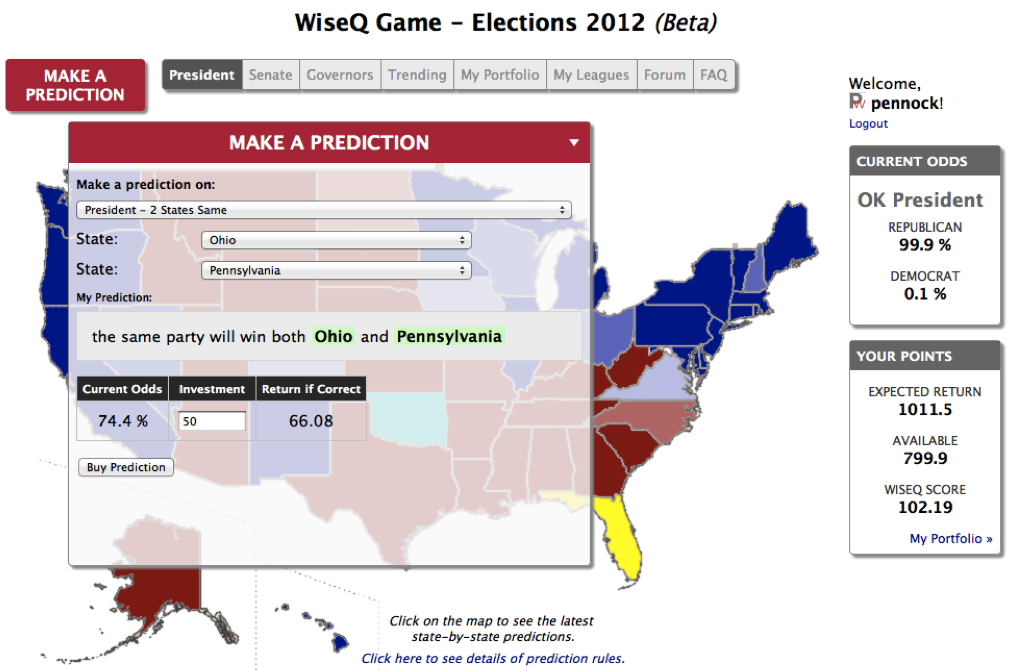

The full list of authors are: Shipra Agrawal, Moshe Babaioff, Yoram Bachrach, Wei Chen, Sofia Ceppi, Nikhil R. Devanur, Fernando Diaz, Hu Fu, Rafael Frongillo, Daniel Goldstein, Nicole Immorlica, Ian Kash, Peter Key, Sébastien Lahaie, Tie-Yan Liu, Brendan Lucier, Yishay Mansour, Preston McAfee, Noam Nisan, David M. Pennock, Tao Qin, Justin Rao, Aleksandrs Slivkins, Siddharth Suri, Jennifer Wortman Vaughan, and Duncan Watts.

The full list of papers are:

Optimal Auctions for Correlated Bidders with Sampling

Hu Fu, Nima Haghpanah, Jason Hartline and Robert Kleinberg

Generalized Second Price Auction with Probabilistic Broad Match

Wei Chen, Di He, Tie-Yan Liu, Tao Qin, Yixin Tao and Liwei Wang

Optimising Tradeâ€offs Among Stakeholders in Ad Auctions

Yoram Bachrach, Sofia Ceppi, Ian Kash, Peter Key and David Kurokaw

Neutrality and Geometry of Mean Voting

Sébastien Lahaie and Nisarg Shah

Adaptive Contract Design for Crowdsourcing Markets: Bandit Algorithms for Repeated Principalâ€Agent Problems

Chien-Ju Ho, Aleksandrs Slivkins and Jennifer Wortman Vaughan

Removing Arbitrage from Wagering Mechanisms

Yiling Chen, Nikhil R. Devanur, David M. Pennock and Jennifer Wortman Vaughan

Information Aggregation in Exponential Family Markets

Jacob Abernethy, Sindhu Kutty, Sébastien Lahaie and Rahul Sami

A General Volume†Parameterized Market Making Framework

Jacob Abernethy, Rafael Frongillo, Xiaolong Li and Jennifer Wortman Vaughan

Reasoning about Optimal Stable Matchings under Partial Information

Baharak Rastegari, Anne Condon, Nicole Immorlica, Robert Irving and Kevin Leyton-Brown

The Wisdom of Smaller, Smarter Crowds

Daniel Goldstein, Preston McAfee and Siddharth Suri

Incentivized Optimal Advert Assignment via Utility Decomposition

Frank Kelly, Peter Key and Neil Walton

Whole Page Optimization: How Page Elements Interact with the Position Auction

Pavel Metrikov, Fernando Diaz, Sébastien Lahaie and Justin Rao

Local Computation Mechanism Design

Shai Vardi, Avinatan Hassidim and Yishay Mansour

On the Efficiency of the Walrasian Mechanism

Moshe Babaioff, Brendan Lucier, Noam Nisan and Renato Paes Leme

Longâ€run Learning in Games of Cooperation

Winter Mason, Siddharth Suri and Duncan Watts

Contract Complexity

Moshe Babaioff and Eyal Winter

Bandits with concave rewards and convex knapsacks

Shipra Agrawal and Nikhil R. Devanur