I wrote an essay on “new media” for an entrepreneur friend in February 2004. (My friend launched a new air sports league and .tv channel, hence the emphasis on sports near the end.) I decided to take my own advice and relinquish control. Here it is, with minor re-touches marked and links added. Most of the points remain applicable in 2009. If anything, I’m a little disappointed that, five years later, we haven’t made more progress toward “everything over IP, everywhere”. Sure, Hulu is nice but I still pay obscene amounts to send text messages and watch The Terminator over proprietary pipes.

‘Digital’ means everything and nothing at once. And that’s the point. Music is digital. Movies are digital. Books, news, commentary, communication, ideas, and sexuality are all digital. Even money is digital. Characterizing something as digital conveys no information precisely because most anything can and will be digital. From television to telecom, from Hollywood to Madison Avenue, the transition to digital will take down giants and crown new kings.

Why does digital matter to media? There are three reasons: convergence, copying, and control.

Convergence. Because all content and communication are digital, the delivery mechanism no longer matters. You don’t need a TV to watch television programs. You don’t need a phone to talk to a friend. You don’t need a fax to get faxes or a CD player to hear CDs. All you need is a machine that understands digital and a communications system that carries digital. Today’s best devices for understanding and communicating digital are, respectively, the computer and the Internet. That’s all you need. Tomorrow’s TVs may look and feel and act much like today’s TVs, but rest assured they will be computers in disguise, and they will be connected to the Internet. There’s no inherent reason why Friends should be watched on Thursdays at 8pm on NBC interspersed with commercials. It can, should, and will be watched at the viewer’s leisure, uninterrupted. There is no reason that the biggest “television†phenomenon of 2008 won’t be seen on Yahoo!, for example. [In hindsight, this example was wildly optimistic — and YouTube/2020 now seems more likely — though in 2008 viewers flocked to Yahoo! for the Olympics, the election, and short-form video.] Notions of channels and schedules will be virtually meaningless. We already see this happening with DVRs like TiVo, and the blurring will continue with computer/TVs providing access to movies, music, your photo album, weather, news, and the Web. Cable, phone, and satellite companies are providing Internet access. Internet portals and Internet providers are delivering phone calls, movies, TV shows, [radio,] and email all over the same wires [and wavelengths].

There is now, and will continue to be, fierce opposition to convergence from established players. Cable companies objected vehemently to allowing local stations onto satellite TV. Broadcast networks fear TiVo. The Recording Industry Association of America (RIAA) is in a state of panic panicked, suing everyone in sight, including their own customers. Lobbying and lawmaking will slow convergence, but the changes are all but inevitable. While the RIAA and groups like it scramble to rearrange deck chairs on the Titanic, opportunists are busy building entirely new ships.

Copying and Control. Once a piece of media content—whether it is a song, a movie, or an article in a scientific journal—is converted into digital ones and zeros, it can be copied (perfectly) and distributed at almost zero cost. Given the decentralized nature of the Internet and the vagaries of international law, once a piece of content escapes there is almost no reining it in. Current media business models rely on tight controls. Control of scheduling. Control of delivery and distribution. Control of store shelves. Control of artists and content creators. Control of consumers’ attention. But digital content resists nearly all attempts at control. Software and hardware copy-protection schemes are hacked or circumvented. High-quality analog copies of digital content are simply impossible to stop. Artists can self-publish their work and distribute it worldwide. Consumers can suddenly find content that’s not broadcast at primetime or placed at eye level in the store.

Note that digital does not mean the end of marketing, influence, and celebrity. Capturing the public’s interest and attention are still necessary. A self-published song does not magically attract listeners. Talent, personality, advertising, branding, and social forces will still play large roles in driving media success in the digital era. But convergence means that any number of players can provide the marketing and distribution needed, breaking current oligopolies, and almost certainly benefiting artists and consumers alike. Successful business models for the next generation of media companies must address the loss of control on all three fronts: content, artists, and consumers. Content will be copied. Artists will self-publish and shop for marketing services. Consumers will view what they want when they want to.

The New Business of New Media

Media is certainly not dead. Certain aspects will probably never change. People yearn for good stories, for entertainment, for escapism, for information. People flock to charisma and celebrity. People communicate insatiably. From a business perspective, there is undeniable value in having and holding the attention of a number of people.

Although the face of tomorrow’s media is impossible to predict, certain sectors are poised to benefit enormously from the emergence of digital, or are at least less susceptible to its problems.

Here are some winning strategies:

Embrace convergence. Convergence offers almost limitless flexibility in delivering and customizing content. Sports fans can watch an event from any camera, watch real-time animated renderings allowing absolute viewer control, interact with video games with parallel story lines, or chat with other fans. News broadcasts can allow viewers to examine any topic to any depth. Toys can react to signals embedded in Saturday morning cartoons. Consumers can create customized “channels†delivering content tailored to their needs and whims. Companies that capture the voicexyz-over-Internet market will be big winners in the new-media world.

Embrace copying. There is no doubt that a large part of the business value of media lies in its ability to influence (usually via advertising), which in turn benefits most from widespread adoption. For a business built on influence, free and unfettered copying should be encouraged rather than litigated. Not everything has to be free. In some cases, people will pay to get content faster. Live events are the most obvious situation where copies are less valuable than originals. People may pay for live feeds of sporting events, for example. In many cases, people will pay for higher-quality content, for example higher-resolution movies or better-sounding music. For example, with a good digital rights management system, pristine digital copies might be sold for a small premium, even while slightly tarnished analog copies (which are essentially unstoppable) proliferate. People may pay a premium for convenience, anonymity, quality assurance, or to obtain versions stripped of commercial messages. Clearly delineated commercials are a problem in a world where time shifting and copying are prevalent: people will simply skip commercials. So commercial messages must be embedded directly in the content, using product placement or endorsements.

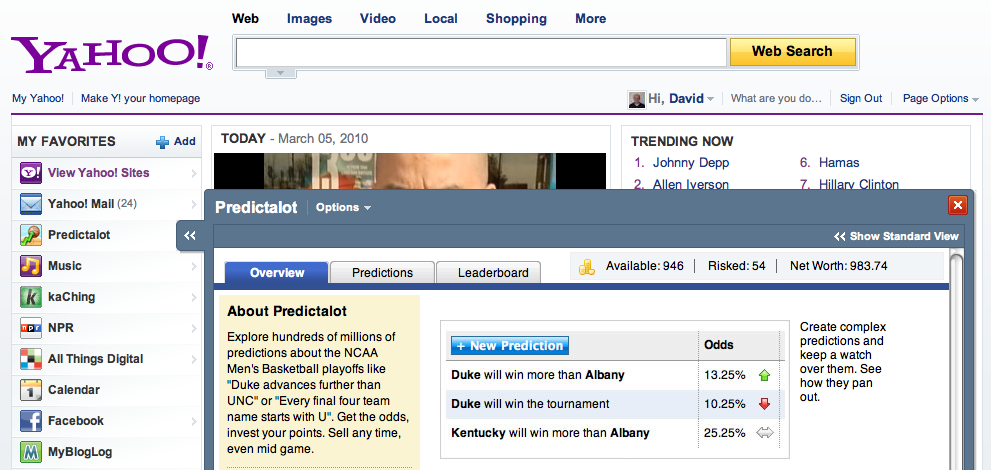

Real-time gambling offers a natural source of revenue for sporting events and other live events. Real-time gambling is spreading quickly throughout the UK and Europe, where it is well regulated and taxed. Real-time gambling offers a situation where live feeds are essential, and copies less damaging. In fact, wide dissemination of copies could be valuable as a marketing device to drive interest in the live events and concurrent gambling services.