Is the growing prediction market industry graveyard an omen?

It’s hard to ignore the accumulating bodies, including, may they rest in peace, PPX, Hubdub, Protrade, Tradesports, Newsfutures, Hedgestreet, Yoonew, TheTicketReserve, FirstDibz, BettorFan, ipreo, Tech Buzz Game, The WSX, Storage Markets, FTPredict, real HSX, BizPredict [1], CasualObserver.net, Cenimar, Alexadex [2], Askmarkets, Truth Markets, BetBubble, Betocracy, CrowdIQ, Media Mammon, Owise, RIMDEX, Trendio [3], TwoCrowds, BBC celebdaq/sportdaq, Betfair Predicts, chrisfmasse.com [4], and more.

Is this churn rate normal for startups in general, even healthy? Is it a sign of PM’s place in the trough of the hype cycle? Is the current climate an opportunity for those left standing or someone new? Or does it simply suggest that prediction market proponents like me have lost?

A number of media-PM partnerships which on their face seem perfectly natural are history: USA Today+Newsfutures, Popular Science+HSX, Business 2.0+ConsensusPoint, Financial Times+Intrade, Techcrunch+Askmarkets [5], ABC7+Inkling [6], and CFO Magazine+Crowdcast.

At least two former PM companies found success only after switching gears: Protrade became Citizen Sports before being acquired by Yahoo! and Nigel euthanized Hubdub to focus on FanDuel. Cocision, launched just last fall, has already abandoned its PM roots in favor of breezy Q&A and voting.

Usable Marketeer Alex Kirtland nails exactly why all the “predict Wall Street” games may be fun but aren’t likely to be predictive. Research papers, including my own, report that the accuracy advantage of prediction markets, while real, may often be small compared to statistical models or polls.

Intrade, one of the most cited and well studied PMs, is trying hard with a radical remake that looks great and a new fee structure that’s likely to improve low-probability predictions. I don’t have any inside knowledge but the company and the exchange don’t seem especially strong; I even spotted some bugs in their exchange rules. The venerable Iowa Electronic Market and Foresight Exchange that, together with Robin, started it all, look, well, venerable. Betfair is still a powerhouse and soared in its IPO just last fall, but is perhaps showing signs of age as personnel turn over and the product remains decidedly 1.0.

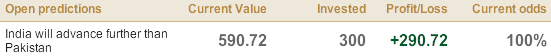

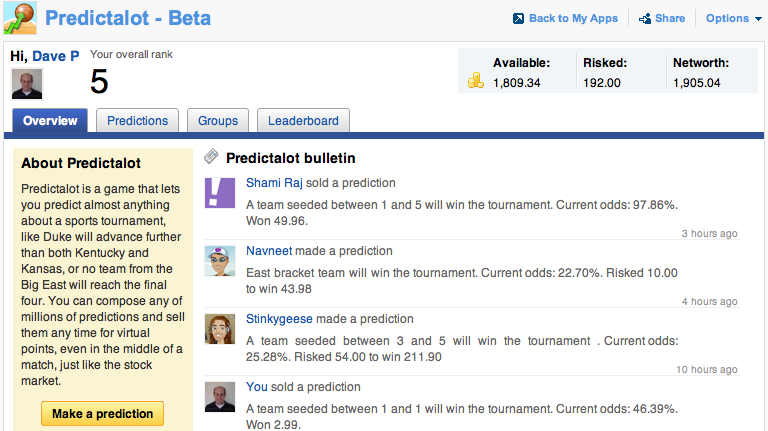

A few startups like Crowdcast, MediaPredict, smarkets, betable, socialico/PremierX, and InklingMarkets are nimble and promising, but none have hit home runs yet. The SimExchange is well designed and chugging along. Bet2Give [7] and CentSports are both fascinating concepts and still alive, two of the most intriguing real-money markets. Others like ExtZy, RealityMarkets and PublicGyan are hanging on. New entrants like Prediculous, Predictalot, Predictopus, 4cast, beansight, I Called It, IBET, Prediction Book, HuffPo’s Predict the News, Slate’s Lean/Lock, Ultrinsic, Knew The News, Cantor Gaming’s Oracle [8], and the MNI Forecast Competition (Lumenogic) are still coming up, though at an admittedly slower pace than four years ago.

Update 2011/5/10: Crowdpark, a German company with an office in San Francisco, launched in English last December with a web game and an impressive, well-designed Facebook game that’s already attracted 500,000 monthly active users, the 11th fastest growing Facebook app in April. They have an interesting “patent pending” automated market maker that I can’t find any details about (yet).

One PM mailing list is of questionable transparency and another is often silent. The Prediction Market Industry Association is inactive.

The final post on Newfutures Blog in 2009 declares that “resistance is futile”. But is it the world’s resistance of PMs, or PMs resistance of irrelevance, that is futile?

Despite the negative tone of this post, I believe it’s the former. The prediction market spring will come. Here’s why. Prediction markets offer:

- Accountability

- Meritocracy

- A marketplace to reward information release

- Real-time updates

- Accuracy

- Increasing ease of use, as the technology matures and diffuses

- Self funding

No other prediction technology offers the same. There’s a great opportunity here for the companies that have squirreled away enough nuts to survive the winter.

P.S. Also read Paul Hewitt’s Prediction Market Prospects 2010.

Footnotes:

[1] In 2006, the teaser prediction for BizPredict was “Do you know when MySpace’s traffic will surpass Yahoo’s?”.

[2] Techcrunch declared Alexadex “the web 2.0 stock market”, back when Techcrunch encouraged Diggs

[3] I like Trendio’s post-mortem:

..Trendio rapidly became popular and attracted massive traffic from all over the world, as well as attention from major newspapers, TV-channels and blogs. To develop Trendio as a large-scale web property and an income-generating business would however have required to dedicate time and resources that I wasn’t able to provide.

I still believe there is a massive potential for prediction markets, both as games and for their predictive power…

[4] A truly sad loss, and not just because of the 2005 awards. Someone should archive the archive to be sure this gem, as information-rich as it was verbose and disorganized, survives. Hang in there Midas Oracle!

[5] Ironically, upon launch of Askmarkets in 2008 Techcrunch asked “who’s going to the deadpool?”

[6] Technically not dead, but seems neglected.

[7] We independently considered an idea similar to bet2give at Yahoo! in 2007 but never pursued it.

[8] Cantor Gaming’s odd-setting mechanism seems effectively like an automated market maker with intelligent prior.