On Thursday April 26, 2012, I resigned from Yahoo! after nearly 10 without actively changing jobs. Here is the full text of the goodbye letter(s) I sent. It’s the kind of long-winded last salvo that few people actually read, and now I’m foisting it upon you, dear reader, but I can’t help myself. Writing it brought back many wonderful memories and a tinge of sadness at the end of a truly amazing work environment for me, but I found the exercise rewarding. I really appreciate the many kind words and well wishes: some were poignant and immensely gratifying. The feeling is mutual. If nothing else, throughout my career I have had the great fortune of working with amazing people who are equal parts brilliant, effective, and nice, including my bosses, peers, reports, and students.

On Thursday April 26, 2012, I resigned from Yahoo! after nearly 10 without actively changing jobs. Here is the full text of the goodbye letter(s) I sent. It’s the kind of long-winded last salvo that few people actually read, and now I’m foisting it upon you, dear reader, but I can’t help myself. Writing it brought back many wonderful memories and a tinge of sadness at the end of a truly amazing work environment for me, but I found the exercise rewarding. I really appreciate the many kind words and well wishes: some were poignant and immensely gratifying. The feeling is mutual. If nothing else, throughout my career I have had the great fortune of working with amazing people who are equal parts brilliant, effective, and nice, including my bosses, peers, reports, and students.

——– Original Message ——–

Subject: last Yodle (and last corny Yodle joke)

Date: Wed, 25 Apr 2012 16:44:31 -0400

From: David PennockAfter 8 wonderful years (almost 10 if you include Overture), it is with

very mixed emotions that I leave Yahoo!. My last day is tomorrow,

Thursday April2526. You can reach me in plenty of ways and I hope you do:[my email address]

+1-732-XXX-XXXX

Y!IM pennockd | facebook pennockd | twitter pennockd | linkedin

http://dpennock.com | http://blog.oddhead.comI’ve grown to love this company (purple blood, yada yada) and one of the

deep ironies is that I have a feeling Scott Thompson may actually know

what he is doing and that maybe just maybe Yahoo!’s return to revenue

growth and good public perception will finally come (note I didn’t say

return to profitability — a steady $1 billion in cashmoney profit in

our pocket every year is very far from shabby). I plan to hold on to

some of my stock.In the early 2000s Google was an amazing Bem+Wom story yet almost no one

(me included) had a clue how they would make money. In 2002, Gary Flake

introduced me to Overture, a company already making hundreds of millions

on search, and suddenly it was clear. I joined Gary in what became

Overture Research and later, under Usama Fayyad’s protective wing, the

inception of “Yahoo! Research Labs”. When Gary left, we hired Prabhakar

and Ron. The rest is history. Andrei, Andrew, Raghu, Ravi, Ricardo,

Preston, Duncan. An absolutely amazing place that was my pleasure to

watch grow and mature. I still remember the excitement of our first

offsite at Half Moon Bay to map out the future of the place.* I remember

a fateful week when Preston, Duncan, and David Reiley simultaneously

gave up their tenure to stay at Yahoo!.From the beginning Prabhakar saw the importance of including social

science research in the mix for online media. In my little corner, where

we mixed computer science and economics (“algorithmic economics” we

called it), I believe we had enormous effect both internally and

externally. In 2007, Jeff MacKie-Mason, one of our Big Thinker lecturers

and now Dean of the School of Information at the University of Michigan,

wrote (ok, informally to me in email) that our group was “the most

exciting and successful group I’ve seen crossing the CS/Econ boundary”.

If imitation is the sincerest form of flattery, I believe we had a

significant positive impact on the growth in hiring in the social

sciences and in algorithmic economics at both Google and Microsoft. In

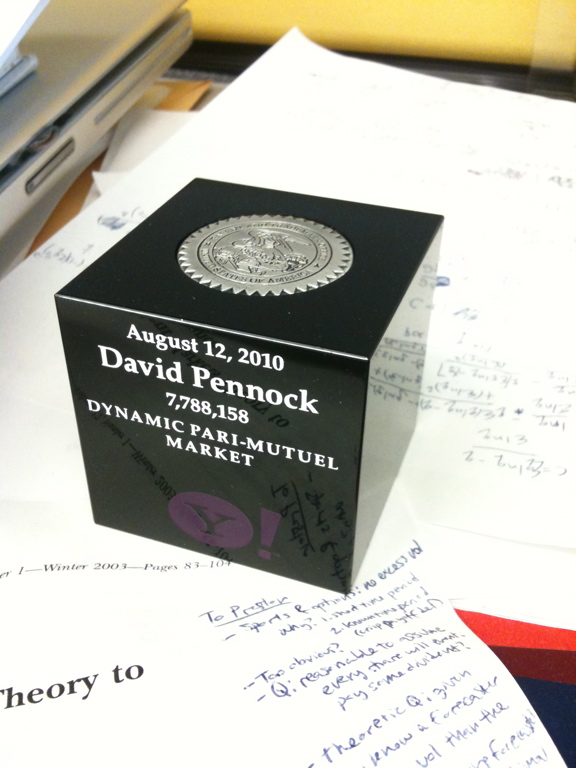

our group alone, we published more than 70 papers including at least two

award winners (Arpita just this year). We literally wrote the book

(chapters) on sponsored search and prediction markets. We co-founded the

Ad Auctions Workshop and NYCE Day. People who left often did

fantastically well, including Yiling Chen to Harvard, Mohammad Mahdian

to Google, and Dan Reeves to found his own successful startup Beeminder.

We filed dozens of patents (take that fb!). Former intern Nicolas

Lambert who is now a Stanford professor once told me he hoped to one day

say “it all started at Yahoo!”. I just left a Ph.D. student’s defense

whose three (!) weeks at Yahoo! were good for two chapters in his

thesis. We’ve had academic visitors leave after a week here and follow

up that they wanted to apply for a job — the environment was that great.Inside Yahoo!, we worked on sponsored search (“squashing” and so much

more by the incomparable Sebastien Lahaie, who we recently discovered is

the central hub of research in New York), display ads, and UGC among

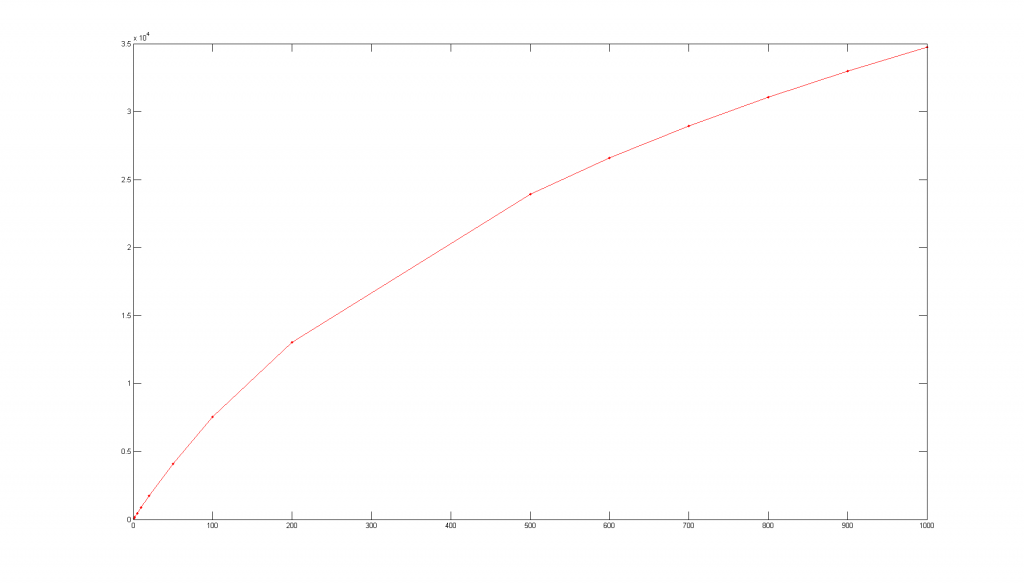

many topics. My passion has been in prediction (markets), and some of my

best memories have been trying to play product manager for a day (or a

couple months) for Predictalot and The Signal. Often it felt more like

operating a startup but with incredible advantages in resources, people,

and of course access to that monster traffic firehose. This was Yahoo!

at it’s best — marshaling talent from all over the globe in many

divisions and specialties to produce a product that no one had ever seen

before, and that no one including us even knew would work. One of the

saddest parts of departing now is leaving The Signal behind, an

incredible effort and in many ways our biggest and best, led by David

“force-of-nature” Rothschild and so many people behind it. Sadly, some

were let go and others are leaving on the own accord, and we’ll never

know what could have been in a counterfactual universe. Yet I believe

The Signal will live on in the good hands of those who remain, including

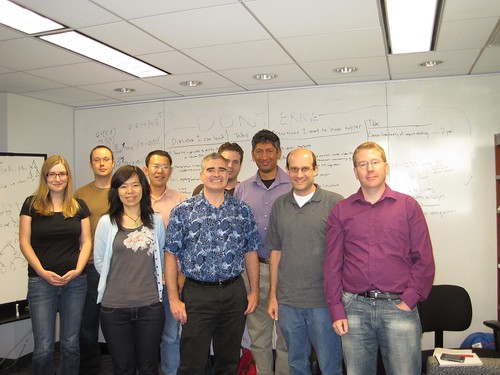

Chris Wilson, Alex, Ingemar, and the absolutely phenomenal Bangalore team.By far the best part of working at Yahoo! was the people. It’s been my

pleasure to work with so many fantastic colleagues in Labs and

throughout the company. In the recent turmoil many in Labs have been, as

Preston said, “evaluated by the market”, and came out looking pretty

darn good, with calls, interviews, and offers from the best companies

(Facebook, Google, Microsoft) and universities. Early on we set a goal

to always hire above the mean, and I truly believe we did that. (Having

been here from the beginning, you can see where that leaves me in this

incredible crowd.) It’s a cliche but a true one: I am only as good as

the people working with me, and I’ve truly been blessed with amazing

colleagues, bosses, employees, postdocs, and interns. To Sebastien,

Arpita, Giro, and David Rothschild, plus Mridul, Navneet, Sudar, Arun,

Shrikant, Kim, Chris, Janet, Ron, Michael and dozens more and everyone

who has come before, from Preston & Prabhakar on down, I can’t thank you

enough and I owe you almost everything.Goodbye for now,

Dave* For history buffs, these were the people at the initial Yahoo!

Research offsite: Prabhakar Raghavan, Dennis DeCoste, David Pennock,

Omid Madani, Shyam Kapur, Andrew Tomkins, Winton Davies, Ravi Kumar,

Bernard Mangold, Ron Brachman, Marc Davis, Michael Mahoney, Kevin Lang,

Seung-Taek Park, and Dan Fain.** I also remember the first few days of Yahoo! Research New York in

2005, with just Ron, John, and I. It’s amazing to see what we have

become since.*** An even more arcane note of history: the Overture control room made

a cameo as NASA Mission Control in James Cameron’s 2003 movie Ghosts of

the Abyss. I am on somewhere on the cutting room floor trying to muster

that awestruck look one gets upon seeing alien life for the first time.

——– Original Message ——–

Subject: one more thing

Date: Thu, 26 Apr 2012 11:20:01 -0400

From: David PennockI’ll abuse my final act of spam to add one more thing. For those of you

remaining, you’re in good hands with Ron. I believe he can do something

special with Labs. In case you’re not familiar with his background, Ron

is frighteningly smart (Princeton undergrad, Harvard Ph.D.), was a

pioneer in artificial intelligence, wrote a seminal book on Knowledge

Representation, served as President of AAAI, the main AI society, ran

research groups at Bell Labs & AT&T, and is a highly organized, fair,

diligent manager who listens actively, gets things done, and, in

addition is a genuinely nice person. Best of luck to everyone.

Next post: A dream job come true.