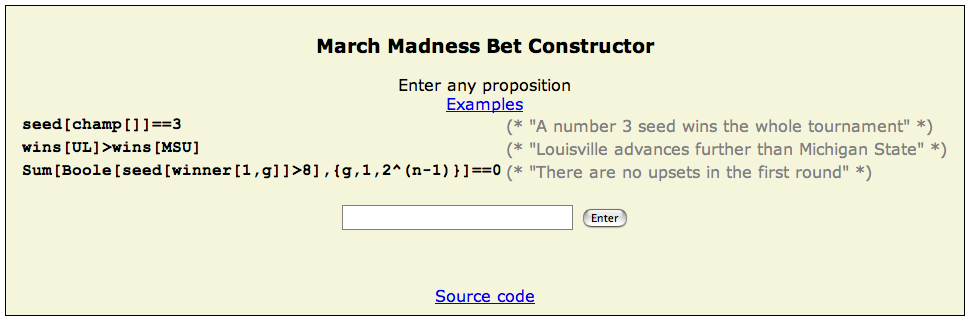

Our first prototype of Predictalot was written mainly in Mathematica with a rudimentary web front end that Dan Reeves put together (with editable source code embedded right on the page via etherpad!). It proved the concept but was ugly and horribly slow.

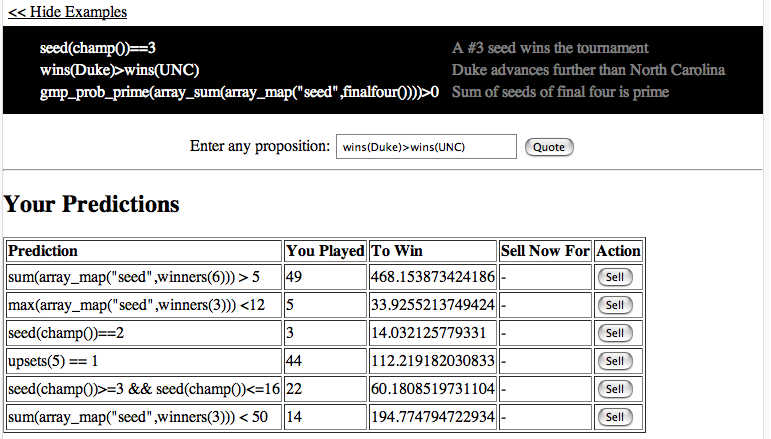

Dan and I built a second prototype in PHP. It was even uglier but about twice as fast and somewhat useable on a small scale (at least by user willing/able to formulate their own propositions in PHP). Yet it still wasn’t good enough to serve thousands of users accustomed to simplicity and speed.

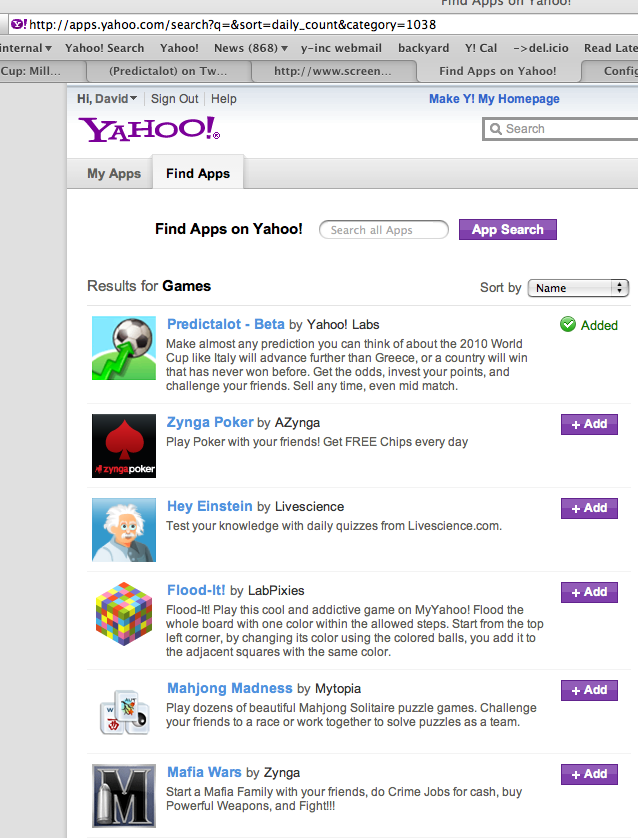

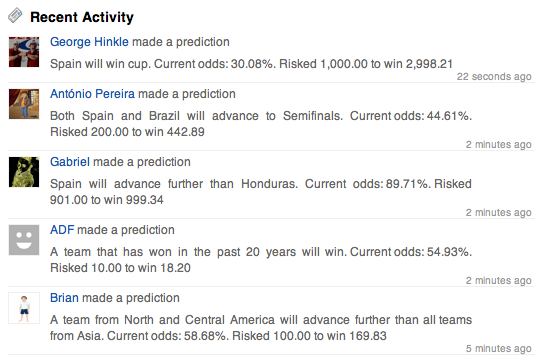

The final live version of Predictalot was not only pleasing to the eye — thanks to Sudar, Navneet, and Tom — but pleasingly fast, due almost entirely to the heroic efforts of Mridul M who wrote a mini PHP parser inside of java and baked in a number of datbase and caching optimizations.

It seems that high-level programming languages haven’t climbed high enough. To field a fairly constrained web app that looks good and works well, we benefit greatly from having at least three specialists, for the app front end, the app back end, and the platform back end (apache, security, etc.).

Here’s a challenge to the programming language community: anything I can whip up in Mathematica I should be able to run at web scale. Math majors should be able to create Predictalot. Dan and I can mock up the basic idea of Predictalot but it still takes tremendous talent, time, and effort to turn it into a professional looking and well behaved system.

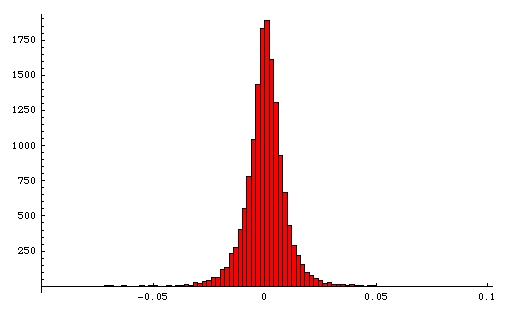

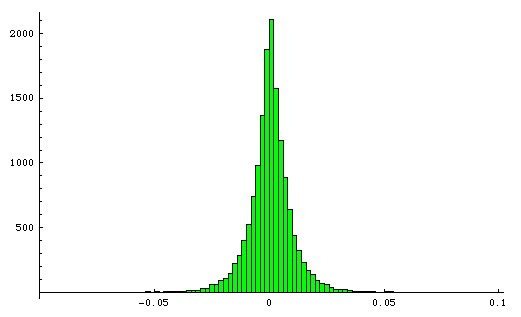

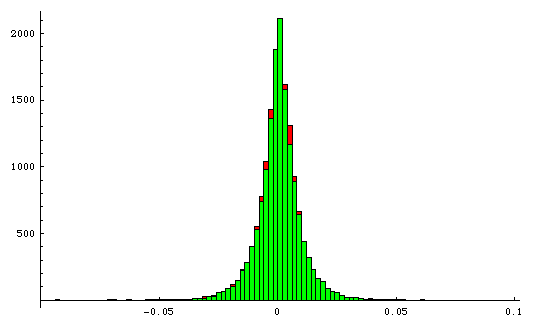

The core market math of Predictalot — a combinatorial version of Hanson’s LMSR market maker — involves summing thousands of ex terms. Here we are in the second decade of the new millenium and in order for a sum of exponentials to execute quickly and without numeric overflow, we had to work out a transformation to conduct all our summations in log space. In other words, programming still requires me to think about how my machine represents my number. That shouldn’t qualify as “high level” thinking in 2010.

I realize I may be naively asking too much. Solving the challenge fully is AI-complete. Still, while we’re making impressive strides in artificial intelligence, programming feels much the same today as it did twenty years ago. It still requires learning specialized tricks, arcane domain knowledge, and optimizations honed only over years of experience, and the most computationally intensive applications still require that extra compilation step (i.e., it’s still often necessary to use C or Java over PHP, Perl, Python, or Ruby).

Some developments hardly seem like progress. Straightforward HTML markup like border=2 has given way to unweildy CSS like style=”border:2px solid black”. In some ways the need for specialized domain knowledge has gone up, not down.

Visual programming is an oft-tried, though so far largely unsuccessful way to lower the barrier to programming. Pipes was a great effort, but YQL proved more useful and popular. Google just announced new visual developer tools for Android in an attempt to bring mobile app creation to the masses. Content management systems are getting better and broader every day, allowing more and more complex websites to be built with less time touching source code.

I look forward to the day that computational thinking can suffice to create the majority of computational objects. I suspect that day is still fifteen to twenty years away.